What Founders and Operators Should Watch Out For In 2026

- Avanish Tiwary & Moulishree Srivastava

- Jan 30

- 7 min read

At the World Economic Forum in Davos this January, the recurring theme was implementation of AI, the risks it carries, and its impact on society.

When the most futuristic conference on earth starts sounding like a policy hearing with a product roadmap attached, you know AI has moved on from being just a feature you bolt onto a product. Rather, it is turning into the substrate that products, teams, and even markets are built on.

We are watching AI rewrite the rules in major sectors including fintech, space-tech, media, gaming, and health-tech, among others.

It has become an integral piece that figures out risk scoring, fraud detection, and customer support in fintech. Things are now moving from manual review to continuous machine-led judgment.

In retail and commerce, discovery is increasingly mediated by answer engines and automated assistants that reduce the distance between intent and purchase.

That same pattern is showing up in media and gaming, where production pipelines are being compressed by AI tooling and where entirely new formats are emerging as models learn to simulate worlds, not just generate assets.

As AI adoption gets more and more mainstream, user interface becomes that important.

That shift is already visible in the way analysts talk about customer service evolving toward autonomous, agentic resolution and commerce being rebuilt.

Put differently, companies are no longer betting only on smarter answers. They are betting on AI that can take actions. And, these companies are making that bet regardless of whether they are a bank, a hospital network, a logistics player, or a consumer app.

With that backdrop, we are throwing light on the top five tech trends that are expected to define 2026.

1. Venture Capital and Market Dynamics

If 2024 and 2025 were about proving that AI could create value, 2026 looks like the year capital starts enforcing the difference between the mere potential of AI and actual outcomes.

It is expected that early stage companies would see a surge in deal activity in 2026, even though liquidity remains the market’s persistent headache.

The logic is simple and slightly uncomfortable for those who are used to building companies the old way. AI has lowered the cost of starting up and accelerated build cycles, so more teams can get to a credible product faster, which naturally pulls deal volume forward.

This matters a great deal for markets like India and Southeast Asia, where capital-efficient, unconventional go-to-market execution and talent depth often outpace availability of late-stage capital.

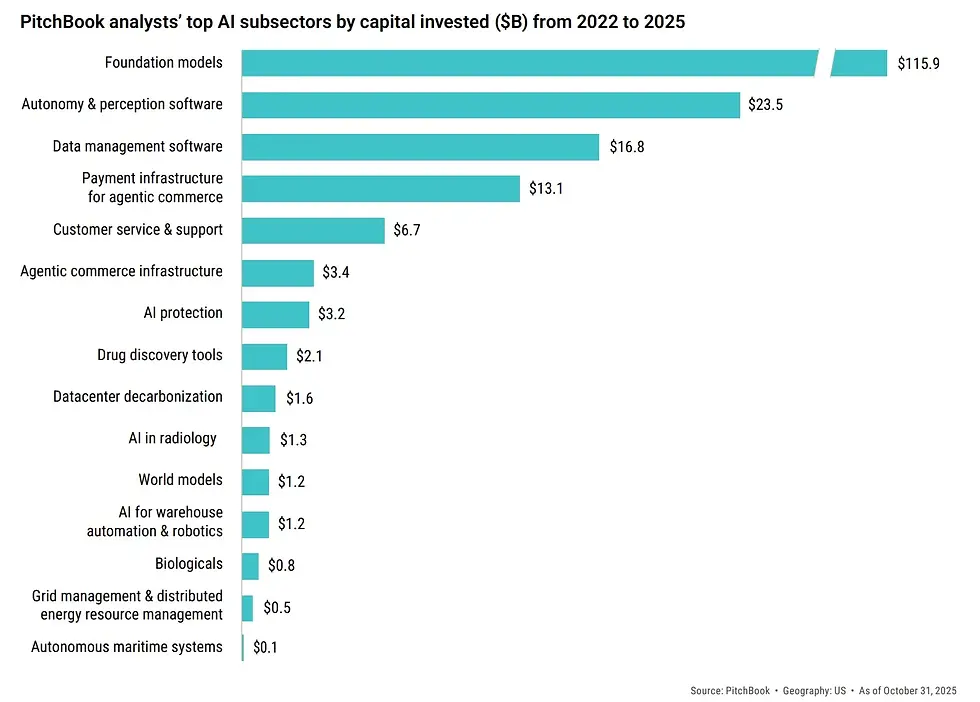

At the same time, the market is becoming more concentrated, and the gap is widening. According to a PitchBook report, top-tier startups would keep raising outsized rounds while mediocre companies struggle to meet growth expectations and win follow-on funding.

In parallel, AI has become ubiquitous in venture, drawing 65% of capital invested through Q3 2025 in the US.

Then comes the exit question, because nothing tests narratives like liquidity. PitchBook’s view is that liquidity should improve, but unevenly, with an IPO window that is open and selective rather than wide open.

Even when IPOs happen, valuation discipline is now part of the ritual. The median IPO valuation for unicorns relative to the last VC valuation is 0.9x year to date, and down-round IPOs are increasingly normalized.

That reality pushes more companies to stay private longer, lean harder on secondaries and tender offers, and treat private capital as a long-duration instrument, which is already how many mega-companies behave.

For founders in India and Southeast Asia, the practical implication is a sharp rise in bar. Capital will still show up for teams that can demonstrate durable distribution, proprietary data, or deep workflow integration. Everyone else will feel tighter terms, longer fundraising cycles, and more pressure to show efficiency.

And that tees up the next trend, because the clearest way to show efficiency in 2026 is to build for agents, not just for users.

2. The Shift to Agentic Infrastructure

Agentic AI is quickly becoming the default ambition, but the more interesting story is the plumbing that has to change to make it real.

The agent wave is pushing software away from single interactions and toward continuous execution, where systems watch intent, co-ordinate tasks, and run processes that look more like operations than like chat.

That is the difference between a bot that clicks buttons and a system that can actually run a workflow.

Teams that build for India and Southeast Asia will feel this early because the region tends to adopt pragmatic automation fast, especially in high-volume functions like support, sales operations, collections, and logistics orchestration.

Customer service and support is a massive market with clear ROI. And once support becomes a proving ground, the same architecture tends to spread to adjacent functions.

Fintech provides the cleanest example of how deep this goes. Commerce has historically been an on-ramp for every platform shift, and the next shift looks like agent-driven transactions that require payments, identity, fraud, loyalty, and inventory systems to be rebuilt for machine customers as much as human ones.

This matters for Southeast Asia’s super-app economies and India’s API-first financial stack, because both regions already have the knack for assembling ecosystems instead of creating monoliths.

As more work moves into agent layers, the strategic leverage of traditional systems of record will be challenged, because the layer that executes work tends to capture mindshare and budget. That sets up an arms race for data quality, governance, and security, which leads naturally into the physical world constraints that will define AI execution in 2026.

3. Industrial Base and National Infrastructure Rebuilt Around AI

When people talk of AI, what they don’t tell you is (at least not as loudly as the other things) that it is increasingly a physical story.

AI Models need power, chips, cooling, and connectivity, and the supply chains behind those inputs are now part of product strategy. The global infrastructure build-out for datacenters and model training is fast approaching a trillion dollars annually, which helps explain why energy capacity and grid optimisation have become board-level topics.

This explains the billions of dollars big tech has invested in Asian markets to set up datacenters in 2025.

One visible response to rapid reliability on datacenters is a surge in technologies designed to reduce the energy use and carbon emissions of AI. This will only work if there is a growing willingness to generate power on-site or optimise consumption aggressively.

In parallel, the opportunity in grid management and distributed energy resource management is gaining prominence.

The other half of the story is sovereignty.

As AI becomes a strategic capability, nations are increasingly motivated to secure domestic capacity in compute, data, and talent, and to reduce reliance on fragile supply chains. You can see hints of this in how investors think about capital destination and concentration risk, with India and Vietnam already appearing on the shortlist of places expected to attract more investment over the next few years.

In practice, that means more public-private collaboration around datacenters, semiconductor packaging, critical minerals, and industrial automation. It also means more scrutiny on where data lives and who can access it.

4. Sector-specific Breakthroughs That Will Feel Mainstream

In 2026, the most compelling AI stories will be the ones that ship into regulated, high-stakes, or high-frequency environments, because those environments create clear workflows and measurable value.

Healthcare is a prime candidate, with AI for drug discovery being the top pick that could double clinical trial success rates. In markets like India and Southeast Asia, where getting an appointment, a test, or a consultation can be hard, the opportunity extends beyond discovery. The commercial winners will be the ones who integrate into messy real-world workflows rather than sitting beside them.

Defense is another area moving from experimentation to production reality. The push is coming from two things: a growing need for systems that can operate with less human control, and procurement pathways that are finally getting clearer. That’s why maritime security and protecting critical infrastructure are becoming major focus areas. This is especially important for drones and sensors operating on and under the ocean, as geopolitical tensions and threats to undersea cables and pipelines increase.

Gaming and media will deliver a different kind of breakthrough, one that changes what content is. AI adoption in game development reached nearly 90% in 2025, and world models are positioned as a new paradigm for AI-driven game design that enables dynamic, persistent virtual worlds. Studios and creator communities across Asia are already built for fast iteration and tight feedback loops, and this shift plays directly to those strengths. At the same time, analysts warn that parts of gaming content development are overheated and may see value destruction without differentiation, which is a useful reminder that tools are not moats.

Over the years, fintech has emerged as a natural test bed for agent-driven commerce. The payment layer for this kind of commerce is being flagged as a major opportunity, with stablecoins and tokenized assets accelerating the shift. Real-time payments and digital ID systems are already strong in Asian countries, so machine-to-machine transactions may arrive sooner than expected. Once money can move on its own, AI-native fraud detection, strong traceability, and security at the model level won’t be optional.

5. The Workforce and Education Rewired for AI Execution

The 2026 story is not just that AI gets better. It is that organisations retool themselves so AI can actually deliver outcomes.

Investors are already pushing in that direction. PwC reports that 92% of investors are calling for executives to increase capital allocation to technological transformation, and 78% would at least moderately increase investment in companies pursuing enterprise-wide AI transformation.

That pressure shows up in hiring plans, operating models, procurement decisions, and the internal politics of who owns automation.

As AI becomes operational, new roles appear. Teams need people who can design workflows, evaluate model behaviour, manage tool permissions, and measure business impact. Just as importantly, they need managers who can treat AI like a production system rather than a demo.

This is where India and Southeast Asia have a natural advantage, because the region has long produced process excellence at scale in IT services, operations, and customer experience. The next evolution is taking that operational maturity and applying it to agent fleets, where the work is less about doing tasks and more about supervising systems that do tasks.

Trust and transparency will be the tension that defines this transition. PwC notes that investors care deeply about AI-related impacts on headcount and performance, yet only 23% believe companies are providing sufficient information on AI’s impact on headcount to a large extent or completely.

In that environment, the most employable skill is not prompt cleverness. It is the ability to translate AI into resilience, cost curves, and measurable execution.

2026 is shaping up to be the year AI stops being a separate line item and becomes the operating system for how markets fund, how companies build, how infrastructure scales, and how people work.

Like Hedwig? Subscribe to it here to get insights on the Asian startup ecosystem and building a sustainable business.

At The Content House, we offer research-based, analytical content that has a strong narrative quality to it. What makes us different in the crowded content market is our ability to convert institutional knowledge and expertise locked inside organizations into content that companies can use to increase brand reach.

Comments