What’s Shaping Asia's Cross-border VC Landscape in 2025

- Moulishree Srivastava

- Jan 31, 2025

- 7 min read

Change is on the cards for the Asian startup ecosystem.

The waves of change are global with major disruptions looming on multiple fronts.

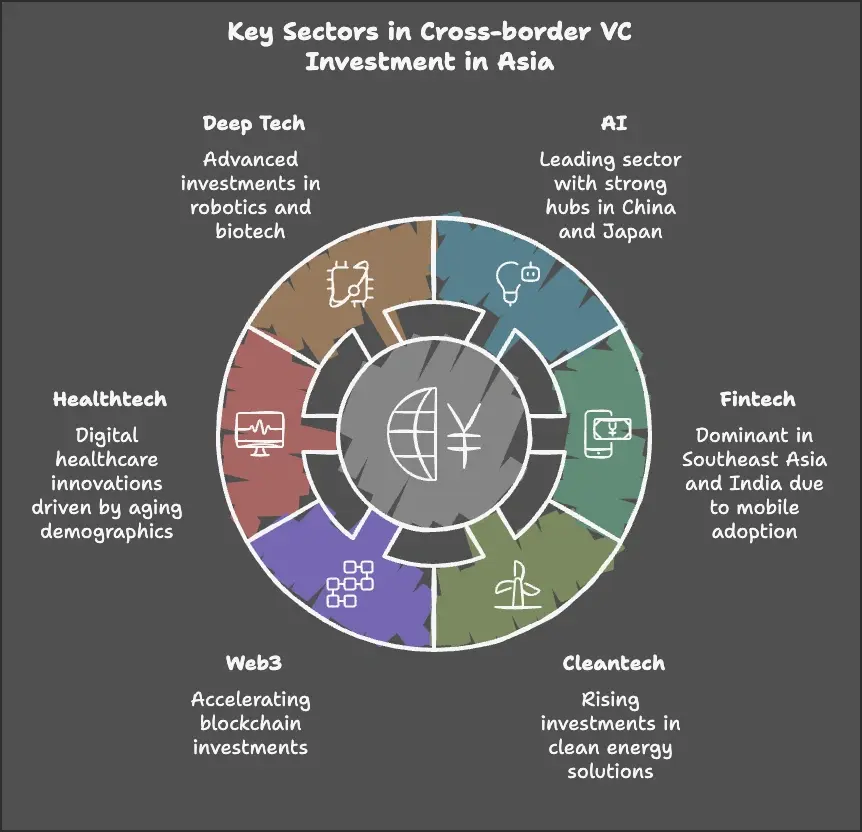

Donald Trump’s trade policies are reshaping international commerce while China shows signs of economic recovery. The AI sector is ferociously growing with technological advancements that could match human capabilities. On the other hand, Asian economies are embracing green energy initiatives while domestic consumption rises.

These are some of the macro themes that will shape the flow of money in Asia.

Venture capital funding, which remained constricted (barring everything AI) last year, is likely to revive in 2025.

At least, that is the hope and expectation. Thankfully, not without any reason.

Public markets are thriving so far in 2025, partly thanks to the high created by Trump’s return. (Discount the recent NVIDIA stock rout due to the meteoric rise of ChatGPT rival DeepSeek).

Consequently, there are signs of investors seeing more exit opportunities this year, with trade sales and IPOs being the key drivers. For instance, strong IPO pipelines in India, China, Singapore, Malaysia, and Hong Kong have already begun to woo investors again.

Notably, cross-border venture capital activity will gain momentum. Why?

Because Asian economies have strong fundamental pillars of growth—fast-growing economies, rising digital adoption, favourable government policies, and of course the promising IPO markets.

But beyond that, VCs are redefining their cross-border strategies due to growing trade tension between the US and China and global companies diversifying their supply chains into the Global South.

After all, it is all about hedging the risks.

This is quite apparent in the rising number of investors from Japan, Korea, and China setting their camps in other Asian economies. And, that’s over and above the increased interest from the US and European investors.

A recent HSBC report put it interestingly: 2025 will be “a year for Asia to double down on Asia.” That’s because more and more regional companies are seeking new markets within Asia.

Parallelly, Asian governments are strengthening regional connectivity, for smoother cross-border investments, capital flows, and payments. And all that is welcome news for investors.

In this edition of Hedwig, we look at Asia’s cross-border VC landscape to see where money is flowing in the region and what it is going into.

Strategic Global Expansion by Asian VCs

It’s not just the US or European VCs that are increasing their exposure in Asian economies. Given the vast growth opportunity, leading Asian venture capital firms are also expanding their investment horizons beyond domestic markets.

Mega funds like SoftBank Vision Fund, HongShan (formerly Sequoia Capital China), Peak XV Partners (formerly Sequoia India and SEA), GGV Capital, and Gobi Partners, and sovereign wealth funds like GIC and Temasek are playing pivotal roles in cross-border activity, especially in late-stage investments.

For example, HongShan (formerly Sequoia Capital China) has accelerated its global investment strategy, targeting deals in Europe and North Asia. Notable investments include celebrity-backed startups like Kylie Jenner's Sprinter and UK online bank Monzo. This expansion is partly due to limited opportunities in China and tightening US restrictions.

Khazanah Nasional Berhad, Malaysia's sovereign wealth fund, is another heavyweight which is stepping up its cross-border investments. It’s shifting its investment focus towards developed markets, including the US, Europe, and Japan, to mitigate risks associated with geopolitical uncertainties. Meanwhile, it will continue with its funding in China and India.

Beyond these big players, plenty of early-stage regional investors have been active across the region. For example, Antler, Iterative, MiraclePlus, TIPS Town, and Smilegate Investment, among many others.

And then there are those which now stepping up their cross-border focus. For example, Global Brain Corporation is all ready to significantly expand its presence in Southeast Asia, with its new partnership with Singapore’s SEEDS. Similarly, the Korean government’s startup acceleration program K-Startup Grand Challenge, which backs promising global startups and facilitates them to do business in Korea, will start looking for their next cohort soon.

Southeast Asia as a Unified Investment Region

Southeast Asia (SEA) is evolving into a cohesive region for investment as more and more startups design their businesses for regional scalability from day one. Investors are backing startups with cross-border strategies, those which are all prepped up to navigate regulatory hurdles and cultural nuances.

The region’s thriving digital economy—projected to triple to US$600 billion by 2030 compared to 2023—is one of the key factors attracting VCs from all markets, making it a hub for cross-border investments.

For context, digital economy-related VC deals make up over 71% of VC deals in ASEAN. And this level of VC investment concentration in the digital economy is more than that of the global average.

Besides, each country in the region has its own charm. If Singapore is a global hub for fintech, AI, and Web3, with a robust regulatory framework and advanced infrastructure, Indonesia is a rapidly growing consumer-driven economy with a huge young and tech-savvy population.

Malaysia boasts of a strategic location, a strong manufacturing base, and a diversified economy with a focus on Islamic finance and green technology; while Vietnam is a dynamic emerging market with a competitive labour force, a thriving manufacturing sector, and strong export-oriented growth.

All these factors are now coming together, and making Southeast Asia more than just a collection of individual markets.

China's Anticipated Rebound

China's GDP rose 5% year-on-year to US$18.42 trillion in 2024, driven by a moderate recovery in the year's final months. This upturn was primarily fueled by supportive policy measures introduced since last September and increased exports ahead of potential US tariffs.

However, experts believe more aggressive measures are needed to sustain the current growth momentum and to increase domestic consumption.

Be that as it may, China's venture capital sector—which faced a major downturn due to economic challenges and geopolitical tensions last year—is expected to rebound in 2025. Thanks to the government’s stimulus packages and new regulatory adjustments facilitating M&A to create more exit opportunities for VCs.

While VC fundraising levels may remain moderate compared to previous peaks influenced by the withdrawal of US limited partners due to restrictive foreign investment rules, more domestic exits will help funds attract new LPs elsewhere. And that means more dry powder to invest in lucrative deals.

In the end, Chinese VCs will continue to play a significant role in shaping the Asian investment landscape. As they double down on new growth opportunities beyond their borders, their investments will continue to grow in Southeast Asia, India, and other Asian markets.

The same is true for tech giants like Alibaba and Tencent, which are making strategic investments across Asia, expanding their ecosystems and influence.

India Continues to be a VC Magnet

India's startup ecosystem is maturing, which has just been reflected in two recent exits—HUL’s acquisition of Minimalist for approximately US$350 million and Everstone’s acquisition of Wingify for US$200 million.

Investors love this kind of market. For instance, Peak XV (formerly Sequoia India and Southeast Asia) made 10x gains in the Minimalist exit.

This also means India is becoming more of a magnet for cross-border capital. Even though India’s projected growth for FY 2024 is 6.4%, the lowest in four years, the country is still one of the fastest-growing economies globally. The prospects are better for the next two fiscal—6.7% growth, as per the World Bank.

This sturdy economic outlook is what foreign investors, Western and Asian alike, have been betting on, and will keep betting on. Moreover, India stands to benefit from the reallocation of venture capital away from China, as investors seek exposure in the Asia-Pacific region.

Global investors are likely to keep pouring money into India's fintech, SaaS and enterprise tech, e-commerce, D2C, health tech, logistics and supply chain, and clean tech among others.

Focus on Sustainability

Asia is the new shining hub for clean tech, green energy, and sustainability-related projects.

That’s primarily due to its vast manufacturing capabilities, innovation in distributed energy systems, and rapid adoption of new technologies. For context, Asia dominates in the production of solar PV modules and battery cells—China is expected to produce 65% of the world's solar modules and 61% of battery cells by 2030.

Asia’s rise coincides with the projected global investments of US$670 billion in clean energy this year, which includes renewables, green hydrogen, and carbon capture, among many others. This will surpass the projected spending on upstream oil and gas, for the first time ever.

Aside from solar power, which is expected to account for half of all cleantech energy investments with Asia leading in capacity expansion, the new hot areas where VCs are likely betting their money are battery technologies (solid-state batteries, EV battery recycling), hydrogen economy (green hydrogen production and infrastructure), carbon capture and storage solutions, and smart grids and energy-efficient technologies.

While China is already a major player—dominating solar, battery, and EV production— India and Southeast Asia are emerging as alternative growth centres for R&D in clean energy.

For instance, India, the third largest renewable energy producer, with its low-cost manufacturing base and government initiatives like Production Linked Incentives, is boosting the production of solar panels and green hydrogen equipment.

Similarly, Southeast Asia is a new hub for biofuels, EV components, and renewable energy.

Particularly, countries like Vietnam, Thailand, and Indonesia are expanding solar and wind projects, leveraging favourable geography and growing VC interest. Meanwhile, technologies addressing waste-to-energy are rapidly scaling in the region as well.

These developments signal Asia's venture capital ecosystem maturing into a more sophisticated and integrated market that increasingly emphasises sustainable development. In a nutshell, the startup ecosystem in Asia has grown in a way that the economies within the continent are looking at each other to expand and thrive.

Like Hedwig? Subscribe to it here to get insights on the Asian startup ecosystem and building a sustainable business.

At The Content House, we offer research-based, analytical content that has a strong narrative quality to it. What makes us different in the crowded content market is our ability to convert institutional knowledge and expertise locked inside organizations into content that companies can use to increase brand reach.

Comments